Author: Mykhailenko A.

Developing ChatGPT required OpenAI to secure $1 billion in initial funding, followed by billions more after its early successes in large language models—Microsoft alone invested $10 billion. By 2023, reports revealed that maintaining ChatGPT costs OpenAI approximately $700,000 per day. Until January 2025, such high expenses seemed inevitable. Then came DeepSeek R1, a low-cost Chinese chatbot that, at first glance, rivals ChatGPT and its main competitors in functionality.

How did an obscure Chinese startup achieve what seemed impossible—challenging the dominance of the U.S., long considered the global leader in AI technology?

- Key Facts About DeepSeek

- DeepSeek’s Capabilities and Advantages

- How DeepSeek Is Disrupting the AI Market

Key Facts About DeepSeek

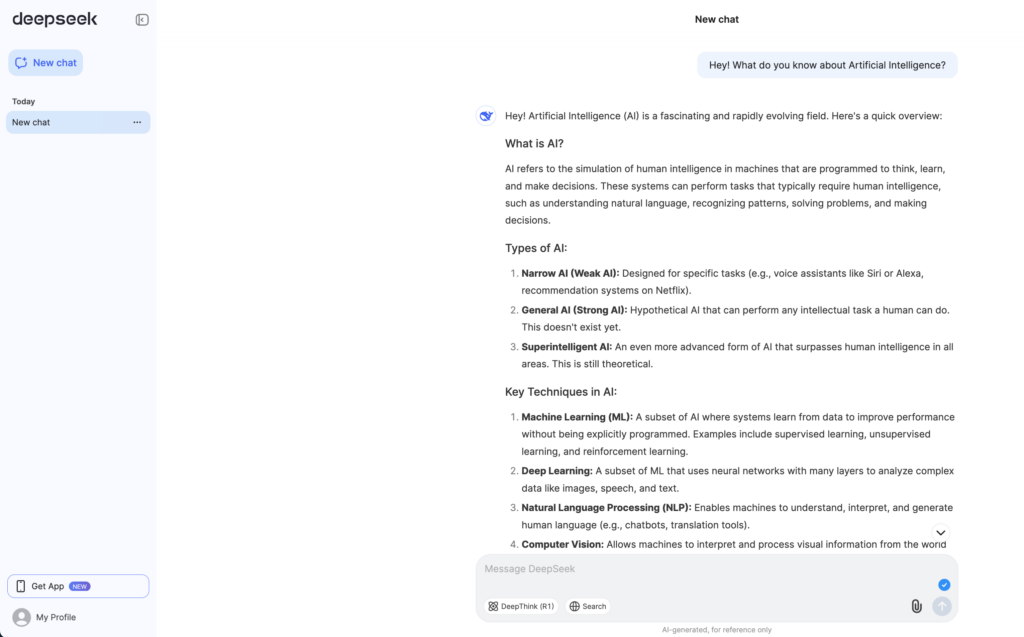

DeepSeek R1 was launched in early January 2025, with its developers proudly announcing on X that it performs as well as ChatGPT. It can generate code, solve mathematical problems, engage in discussions, and even crack jokes—all for free!

The DeepSeek startup was founded in 2023 by Liang Wenfeng, who strategically invested in high-performance GPUs, acquiring thousands of Nvidia chips before U.S. export restrictions to China were enacted. Currently, DeepSeek operates using a mix of Nvidia processors and more affordable Chinese-made GPUs. However, some reports suggest that DeepSeek possesses far more Nvidia chips than officially disclosed, raising questions about the effectiveness of U.S. sanctions aimed at slowing China’s AI progress.

Even Nvidia described DeepSeek as a “remarkable AI achievement”, while OpenAI CEO Sam Altman called the DeepSeek R1 model “impressive”. The emergence of DeepSeek has been compared to the “Sputnik moment”, referencing the USSR’s 1957 launch of the first artificial satellite, which shocked the world.

DeepSeek’s Capabilities and Advantages

DeepSeek R1 is an open-source AI model that started as a side project but ended up revolutionizing the industry. Here’s why:

- Trained on over 2,000 Nvidia H800 GPUs in just 55 days, costing only $5.6 million—a fraction of what major Western companies spent on similar models.

- Optimized GPU usage via distributed training, reducing resource consumption while maintaining high performance.

- Uses reinforcement learning (RL) with a reward-punishment system to refine responses.

- No request limits and no performance drops under heavy usage.

- Outperforms competitors on key AI benchmarks such as AIME 2024, MMLU, and AlpacaEval 2.0.

Ethical Concerns and Data Privacy

Since DeepSeek is developed in China, it censors politically sensitive topics per government regulations. However, a more pressing issue is data privacy—the DeepSeek mobile app is believed to store large amounts of user data on Chinese servers, raising concerns in the U.S., Europe, and beyond. That said, its open-source nature allows users to deploy it independently, preventing data from being sent to China.

How DeepSeek Is Disrupting the AI Market

DeepSeek made waves at the World Economic Forum in Davos on January 20, 2025, where investors and tech leaders discussed the need for the U.S. to accelerate AI development. Venture capitalist Marc Andreessen called DeepSeek “one of the most astonishing breakthroughs” he had ever seen.

Within days, DeepSeek R1 topped the iPhone App Store and Google Play charts. The stock market reacted immediately:

- U.S. and European tech stocks lost nearly $1 trillion in value.

- Nvidia’s stock dropped by 18% ($589 billion) in a single day before partially recovering.

- Microsoft and Alphabet (Google) also saw significant losses.

Can DeepSeek Compete With AI Giants?

It remains to be seen whether DeepSeek can pose a real challenge to industry leaders. However, major tech companies are already re-evaluating their AI spending, questioning whether their massive investments are justified.

Meta Platforms Inc. has assembled an internal team to analyze DeepSeek and determine how it was built. Elon Musk, who runs AI startup xAI, is skeptical, suggesting DeepSeek had far more Nvidia GPUs than it claims.

Meanwhile, Big Tech continues pouring billions into AI:

- Amazon invested $75 billion in AI-related chips and data centers in 2024.

- Meta plans to spend $65 billion on AI projects.

- Microsoft has allocated $80 billion for AI data centers.

However, these companies are struggling to monetize AI, failing to achieve expected returns on their investments.

Another major expense is the infrastructure costs of data centers. In 2024 alone, the top three American hyperscalers spent more than $180 billion on this, and if you add the costs of data center operators (one of the largest being Equinix), this sum at least triples. The growth in expenses is likely to continue, as well as the launch of new computing capacities. Demand for them remains high, and the percentage of unused capacity in the U.S. does not exceed 2.8% — an incredibly low figure. Recently, Mark Zuckerberg, CEO of Meta, announced plans to build a new AI-powered data center “so large that it would occupy a significant portion of Manhattan if placed there.” The main difference between AI-managed data centers and conventional ones is the amount of energy consumed per square meter of space.

At the same time, investments in data centers, which have reached incredible levels, may be questioned in light of the emergence of DeepSeek, as many investors try to figure out whether such high costs are truly justified. Additionally, there are specific limitations unrelated to the emergence of DeepSeek, such as fewer permits and even moratoriums on building new data centers in certain cities.

The explosive debut of DeepSeek has prompted major players in the global market to pay attention to other Chinese AI startups, the number of which has been rapidly growing since the announcement of ChatGPT. In addition to the large and well-known Alibaba and ByteDance, there are many other ambitious AI projects in China. The main ones are known as the Six Tigers: Stepfun, Zhipu, Minimax, Moonshot, 01.AI, and Baichuan. Another project that is closest to DeepSeek in terms of its work is ModelBest. Lesser-known Minimax and Moonshot focus on creating user applications based on models developed by third-party companies. From the perspective of global IT giants, any of these startups could present a new challenge, especially since many of them are financially successful: for instance, Minimax achieved $70 million in revenue last year.

As developers worldwide experiment with DeepSeek, the startup is looking to scale up, despite ongoing U.S. restrictions on high-end GPU exports. Regardless of the challenges ahead, DeepSeek has already reshaped the AI market and strengthened China’s influence in the global AI industry.